Bendigo Trading Plan: Map Your Path to Wealth Acquisition

Define financial aspirations before entering Bendigo markets. A trading plan, integrating market research, risk management, and clear goals, is vital for wealth within. Continuously optimize strategies using historical trends, software analytics…….

Define financial aspirations before entering Bendigo markets. A trading plan, integrating market research, risk management, and clear goals, is vital for wealth within. Continuously optimize strategies using historical trends, software analytics, and reliable news sources to adapt to the dynamic market, ensuring sustainable financial growth.

“Unleash your investment potential with our comprehensive Bendigo trading plan course, designed to guide investors towards wealth acquisition. This article delves into three key aspects of successful trading: understanding and mapping out financial goals, mastering the core components of an effective strategy, and implementing refined techniques for optimal results. Discover how to navigate the markets, manage risks, and harness the power of well-structured planning for a prosperous journey towards your financial aspirations.”

- Understanding Your Financial Goals: Mapping Out a Trading Plan for Wealth Acquisition

- The Core Components of an Effective Trading Strategy: From Research to Risk Management

- Implementing and Refining Your Plan: Tools and Techniques for Successful Bendigo Investors

Understanding Your Financial Goals: Mapping Out a Trading Plan for Wealth Acquisition

Before diving into the world of Bendigo trading, it’s paramount to define your financial aspirations. Understanding your goals is the cornerstone of crafting a successful trading plan – it guides every decision and strategy you implement. Whether your aim is to secure long-term wealth, generate consistent income, or achieve specific milestones, aligning your trades with these objectives is key to maximizing returns and minimizing risks.

This process involves mapping out a clear roadmap with defined entry and exit points, risk management strategies, and investment criteria. A well-structured trading plan not only helps you stay disciplined but also allows for a more calculated approach in navigating the financial markets. By focusing on wealth acquisition within set parameters, investors can make informed choices, adapt to market fluctuations, and ultimately work towards achieving their financial aspirations.

The Core Components of an Effective Trading Strategy: From Research to Risk Management

A well-crafted trading plan is the bedrock of successful investing, serving as a roadmap to navigate the financial markets and achieve wealth within. It’s more than just a collection of rules; it’s a strategic framework that guides investors’ decisions, from opening their first trade to managing their portfolio years later. The core components of an effective trading strategy include comprehensive market research, well-defined risk management techniques, and a clear set of investment goals.

Market research involves staying abreast of economic indicators, sector trends, and company news that can impact stock performance. It’s about understanding the ‘why’ behind price movements. Risk management, on the other hand, ensures investors know their potential downside as well as upside. This includes setting stop-loss orders, determining position sizing, and diversifying across different assets to safeguard capital. By integrating these components into a structured plan, investors can make informed decisions, adapt to market changes, and increase their chances of generating substantial returns while preserving wealth within their investment portfolio.

Implementing and Refining Your Plan: Tools and Techniques for Successful Bendigo Investors

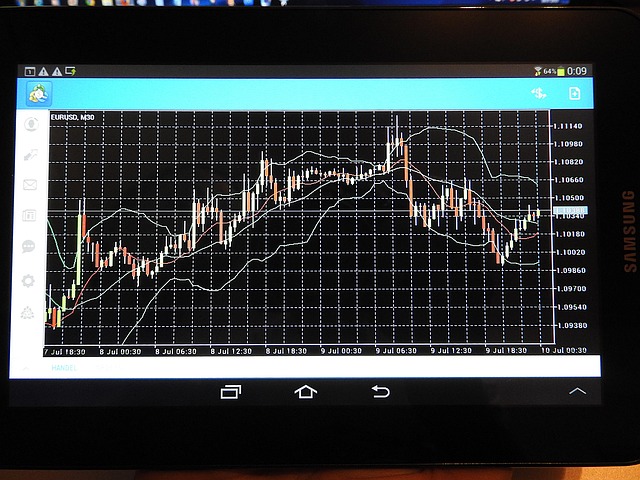

Implementing a robust trading plan is just the first step in your journey to achieving wealth within the Bendigo market. Once you’ve laid the groundwork, it’s time to refine and optimize your strategy. Successful investors understand that their plan is a living document, evolving with the dynamic nature of the market. By utilizing various tools and techniques, you can fine-tune your approach to capitalizing on opportunities and mitigating risks effectively.

These tools include advanced analytics software, which provides insights into historical trends and predicts future market behaviors. Additionally, investors should stay informed through reliable news sources and industry updates, allowing them to adapt quickly. Regular review sessions are essential; analyzing past trades, identifying successes, and understanding failures enable continuous improvement. This iterative process ensures your trading plan remains relevant and aligns with your goals, ultimately contributing to the creation of sustainable wealth.

Creating a robust trading plan is the key to unlocking wealth within your investments. By understanding your financial aspirations, structuring a strategy with core components like research and risk management, and continuously refining your approach, Bendigo investors can navigate the markets effectively. This course equips you with the tools and techniques needed to succeed, enabling you to map out a clear path towards achieving your wealth acquisition goals.