Mastering Australian Day Trading: Fundamentals for Beginners

Day trading in Australia involves a high-risk, high-reward strategy where traders buy and sell financial assets within a single day, leveraging short-term market fluctuations. It requires understanding complex markets, including stocks, commodit…….

Day trading in Australia involves a high-risk, high-reward strategy where traders buy and sell financial assets within a single day, leveraging short-term market fluctuations. It requires understanding complex markets, including stocks, commodities, currencies, and derivatives, while navigating strict ASIC regulations. Australian day traders utilize advanced tools like TradingView charting software, real-time data feeds, and automated platforms to execute trades swiftly and confidently. Success demands a structured plan, risk management through stop-loss orders, regular review, and discipline in making quick decisions based on technical or fundamental analysis. "What is day trading" encompasses these dynamic elements for navigating Australia's lucrative yet regulated financial landscape.

Discover the thrilling world of day trading in Australia with this comprehensive guide. Learn the fundamentals, from understanding what is day trading to navigating the unique Australian financial markets. This article demystifies strategies, techniques, and legal considerations essential for success. Explore powerful tools and software designed to enhance your trading experience. Whether a beginner or seasoned trader, unlock the secrets to building a profitable and sustainable day trading plan tailored to Australia’s dynamic market landscape.

- What is Day Trading? A Beginner's Overview

- Understanding the Australian Financial Markets

- Legal and Regulatory Considerations for Day Traders

- Strategies and Techniques for Profitable Day Trading

- Tools and Software to Enhance Your Trading Experience

- Building a Successful Day Trading Plan in Australia

What is Day Trading? A Beginner's Overview

Day trading is a high-intensity investment strategy where traders aim to profit from short-term price movements in financial markets, typically holding positions for just a few minutes or hours. It’s not about buying and selling stocks, commodities, or currencies for long periods; instead, day traders seek to capitalize on small price fluctuations throughout the day, often using advanced trading tools and real-time market data. This dynamic approach requires constant monitoring of market trends and news, as well as quick decision-making skills.

For beginners, understanding what is day trading involves grasping the concept of leveraging financial markets to generate short-term gains. It’s crucial to recognize that this strategy comes with significant risks, including the potential for substantial losses if not executed properly. Success in day trading demands a deep understanding of market dynamics, risk management techniques, and the ability to analyze complex data swiftly.

Understanding the Australian Financial Markets

The Australian financial markets are a complex yet dynamic ecosystem that forms the backbone of the country’s economic activities. For aspiring day traders, understanding these markets is crucial to navigating the ins and outs of what is day trading. These markets, including the ASX (Australian Securities Exchange), host a diverse range of assets such as stocks, commodities, currencies, and derivatives, each with its unique set of rules and influences. By delving into these markets, traders gain insights into price movements, market trends, and the factors that drive them.

Day trading in Australia operates within tightly regulated parameters, ensuring fairness and transparency. The Australian Securities and Investments Commission (ASIC) plays a pivotal role in overseeing these markets and protecting investors. Traders must familiarise themselves with ASIC’s guidelines, including margin requirements, reporting obligations, and conduct standards. This knowledge is essential for ethical and successful day trading, ensuring compliance while exploiting the opportunities presented by Australia’s dynamic financial landscape.

Legal and Regulatory Considerations for Day Traders

Day traders in Australia must navigate a stringent legal and regulatory landscape. The Australian Securities and Investments Commission (ASIC) oversees financial markets, ensuring fair and transparent trading practices. Understanding ASIC’s regulations is paramount for day traders to avoid legal pitfalls. Non-compliance can result in substantial fines and even criminal charges.

What is day trading, in the context of these regulations? It involves buying and selling financial assets within a single trading day, aiming to profit from short-term price fluctuations. Given the high-risk nature of day trading, ASIC imposes specific rules on traders, including margin lending restrictions, reporting obligations, and continuous disclosure requirements. Adhering to these guidelines is crucial for legal protection and maintaining the integrity of Australia’s financial markets.

Strategies and Techniques for Profitable Day Trading

Day trading involves buying and selling financial assets within a single trading day, aiming to profit from short-term price fluctuations. To be successful, traders must develop and execute effective strategies. One common approach is scalping, where quick trades are made for small gains, accumulating substantial profits over time. This technique requires precision timing and a thorough understanding of market dynamics.

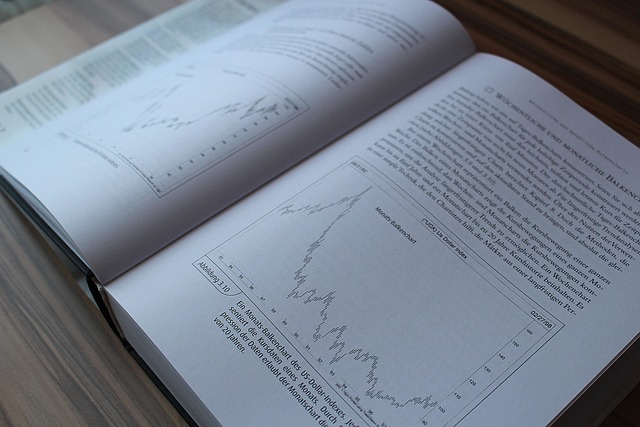

Another popular strategy is momentum trading, focusing on identifying and capitalizing on the continuation of existing trends. Traders use technical indicators like moving averages and Relative Strength Index (RSI) to gauge trend direction and potential reversals. Fundamental analysis also plays a role, considering economic factors and company-specific news that can impact stock prices. By combining these strategies with disciplined risk management, day traders in Australia can navigate the dynamic market landscape and potentially achieve substantial returns.

Tools and Software to Enhance Your Trading Experience

In today’s digital era, day traders in Australia have access to a plethora of tools and software designed to enhance their trading experience. These technologies are essential for understanding market dynamics, executing trades swiftly, and managing risks effectively. Advanced charting software like TradingView offers robust technical analysis features, allowing traders to identify trends, patterns, and potential entry and exit points. Real-time data feeds provide up-to-the-minute market information, enabling informed decision-making.

Additionally, automated trading platforms and algorithms have gained popularity among day traders. These tools can execute trades based on pre-set conditions, offering speed and precision. Furthermore, many brokers now provide proprietary trading platforms with built-in indicators, alerts, and educational resources, fostering a more comprehensive understanding of what is day trading and its intricacies. This ecosystem of technological aids empowers Australian day traders to navigate the markets with greater efficiency and confidence.

Building a Successful Day Trading Plan in Australia

Building a successful day trading plan in Australia involves understanding the unique market dynamics and adopting a structured approach. Before placing any trades, define your strategy by identifying the types of assets you want to trade, such as stocks or currencies. Determine your risk tolerance, setting clear stop-loss orders to protect against significant losses. A well-defined entry and exit strategy is crucial; this could involve technical indicators like moving averages or fundamental analysis based on economic news and company announcements.

Your plan should also incorporate a trading journal where you record each trade’s details, outcomes, and lessons learned. Regularly review and adjust your strategy based on performance data. This continuous improvement process ensures that your day trading plan remains effective as market conditions evolve. Remember, what is day trading in essence? It’s about making quick decisions with precision, leveraging technology, and staying disciplined to capitalize on short-term price movements.

Day trading in Australia offers both exciting opportunities and unique challenges. By grasping the fundamentals outlined in this article, from understanding market dynamics to navigating legal requirements and employing effective strategies, aspiring traders can embark on a well-informed journey. With the right tools, resources, and a solid trading plan, individuals can explore the dynamic world of what is day trading and potentially achieve success within Australia’s robust financial markets.