Mastering Forex: Australian Strategies for Wealth Creation

The foreign exchange (Forex) market offers substantial wealth potential for Australian investors with dynamic liquidity and 24/7 operation. Forex trading strategies demand understanding economic indicators, political events, and country-specific…….

The foreign exchange (Forex) market offers substantial wealth potential for Australian investors with dynamic liquidity and 24/7 operation. Forex trading strategies demand understanding economic indicators, political events, and country-specific trends to decipher currency values. ASIC regulation ensures market integrity and client fund security. Success hinges on defining personal financial goals, risk tolerance, diversification, staying informed, and using analytical tools. Effective portfolio construction blends asset classes and strategy types for growth while mitigating risk. Tailored forex trading strategies, like trend following or range trading, combined with diversification and global economic knowledge, pave the way for significant wealth within the dynamic Forex market.

“Unleash your potential for global financial success with Australian training in constructing forex investment portfolios. This comprehensive guide delves into the dynamic world of foreign exchange markets, exploring how Australians can navigate these global gateways to unlock wealth. We’ll dissect the regulatory landscape, ensuring investor protection, and provide strategic insights for building robust portfolios. Discover proven techniques in asset allocation, diversification, and leveraging effective forex trading strategies to maximize returns within this lucrative market.”

- Understanding Forex Markets: A Gateway to Global Wealth

- Australian Regulatory Framework for Forex Trading: Ensuring Investor Protection

- Developing a Comprehensive Forex Investment Strategy

- Building Your Portfolio: Asset Allocation and Diversification Techniques

- Leveraging Forex Trading Strategies for Optimal Returns

Understanding Forex Markets: A Gateway to Global Wealth

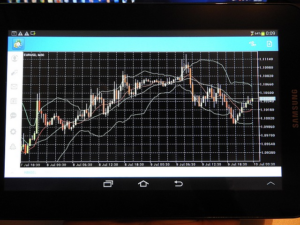

The foreign exchange market, commonly known as Forex, is a global network that connects investors worldwide, facilitating the exchange of currencies and offering immense potential for wealth within. Understanding this dynamic market is the first step towards mastering effective forex trading strategies. With its 24-hour operation and high liquidity, Forex provides traders with opportunities to capitalize on currency fluctuations, enabling them to navigate the global financial landscape.

Gaining insight into economic indicators, political events, and market trends specific to various countries is crucial. These factors significantly influence currency values, creating potential for significant gains or losses. By deciphering these complexities, Australian investors can construct well-rounded portfolios tailored to their risk appetites and investment goals, thus unlocking the wealth within this vast international financial arena.

Australian Regulatory Framework for Forex Trading: Ensuring Investor Protection

In Australia, forex trading is regulated by a robust framework designed to protect investors and maintain market integrity. The Australian Securities and Investments Commission (ASIC) serves as the primary regulator, overseeing financial markets including forex. ASIC enforces strict rules for forex brokers, ensuring they operate transparently and fairly. This regulatory oversight is crucial in safeguarding Australian investors from fraudulent activities and promoting ethical trading practices.

The ASIC’s regulations cover various aspects of forex trading, such as broker licensing, financial reporting, and consumer protection. Brokers must provide clear information about their services and potential risks associated with forex trading strategies. Furthermore, they are mandated to maintain proper records and segregate client funds from their operational assets, ensuring that investors’ wealth is secure. This robust framework not only protects Australian investors but also enhances the overall integrity of the global forex market.

Developing a Comprehensive Forex Investment Strategy

Developing a comprehensive forex investment strategy is akin to navigating a complex labyrinth—it requires careful planning, insightful knowledge, and adaptability. Australian investors can harness the power of forex trading strategies to unlock significant wealth within this dynamic global market. A well-rounded approach begins with defining personal financial goals, risk tolerance, and investment horizon. This foundational step ensures that portfolio construction aligns seamlessly with individual aspirations.

Diversification is a cornerstone of successful forex investing. By spreading investments across multiple currencies and trading styles, Australian traders can mitigate risks associated with currency volatility. Additionally, staying abreast of economic indicators, geopolitical events, and market trends empowers investors to make informed decisions. Leveraging advanced analytical tools and embracing continuous learning fosters a strategic mindset, enabling traders to identify lucrative opportunities and navigate the forex realm with confidence.

Building Your Portfolio: Asset Allocation and Diversification Techniques

Building your Forex investment portfolio is an art that involves careful consideration and strategic planning. The first step in this process is understanding asset allocation – how much of your portfolio should be invested in different types of assets like stocks, bonds, commodities, and of course, currencies. Diversification techniques play a crucial role here; by spreading your investments across various asset classes, you reduce risk and aim to unlock wealth within your portfolio. This approach ensures that even if one market experiences volatility, others might provide stability.

For instance, Forex trading strategies can be tailored to align with your risk appetite and investment goals. Some investors prefer a more conservative approach, focusing on stable pairs and shorter-term trades to preserve capital. Others may adopt an aggressive strategy, targeting higher returns by exploring diverse currency pairs and employing leveraged trading. Effective portfolio construction involves balancing these strategies, ensuring that your investment mix is tailored to your unique circumstances, while still allowing for growth and wealth generation in the dynamic Forex market.

Leveraging Forex Trading Strategies for Optimal Returns

In the dynamic realm of foreign exchange (forex) trading, leveraging effective strategies can be a game-changer for investors aiming to build substantial wealth within this global market. The key lies in understanding various techniques that allow traders to capitalize on currency movements while managing risk efficiently. By employing strategic approaches, such as trend following and range trading, investors can identify profitable opportunities and construct robust investment portfolios.

Forex trading strategies offer a roadmap for navigating the intricate forex landscape, enabling investors to make informed decisions based on technical analysis and market trends. These strategies, when tailored to individual risk profiles and investment goals, can lead to substantial returns. Effective portfolio construction involves diversifying across different currency pairs, utilizing stop-loss orders to protect against significant losses, and staying abreast of global economic events that may impact currency values. Ultimately, leveraging forex trading strategies provides a structured approach to wealth creation in the forex market.

The Australian market offers a robust platform for investors seeking global financial opportunities through forex. By understanding the dynamic nature of forex markets and leveraging well-defined strategies, individuals can navigate this complex landscape effectively. The regulatory framework in place ensures investor protection, providing a secure environment to build wealth. Through a combination of comprehensive planning, strategic allocation, and diverse asset choices, Australian investors can construct robust portfolios that cater to their financial goals while maximising returns within the forex realm.