Unlock Secrets of Day Trading: From Basics to Balanced Wealth

Day trading is a dynamic investment strategy that involves buying and selling financial instruments within a single day to capitalize on short-term price fluctuations. It demands meticulous attention to detail, rapid decision-making, and deep ma…….

Day trading is a dynamic investment strategy that involves buying and selling financial instruments within a single day to capitalize on short-term price fluctuations. It demands meticulous attention to detail, rapid decision-making, and deep market knowledge. Traders use tools like technical and fundamental analysis to identify opportunities and quickly enter/exit positions. Success requires expertise, discipline, and understanding of market trends, with strategies ranging from scalping to swing trading. Balancing risk and reward is crucial, using tools like stop-loss orders and asset diversification to protect against losses while pursuing significant wealth within financial markets.

Unlock the secrets of day trading and discover how this dynamic market can offer immense potential for wealth within. In this comprehensive guide, we unravel the basics of day trading, highlighting its allure and challenges. Learn about essential tools, strategies, and a balanced approach to risks and rewards. From understanding market dynamics to mastering trade analysis, gain the knowledge needed to navigate this exciting financial realm.

- Understanding Day Trading: Unveiling the Basics

- The Allure of Wealth Within: Day Trading's Potential

- Getting Started: Essential Tools and Preparation

- Strategies for Success: Techniques and Trade Analysis

- Navigating Risks and Rewards: A Balanced Approach

Understanding Day Trading: Unveiling the Basics

Day trading, a dynamic and fast-paced approach to investing, involves buying and selling financial instruments within the same trading day. This method is all about capitalizing on short-term price fluctuations, aiming to generate quick profits from seemingly minor market movements. It’s not just about making wealth; it’s a strategy that demands meticulous attention to detail, rapid decision-making, and a deep understanding of market dynamics.

At its core, day trading requires traders to analyze market trends, interpret charts, and execute trades with precision. Traders often utilize various tools and techniques, such as technical analysis, fundamental analysis, or a combination of both, to identify promising opportunities. The goal is to enter and exit positions swiftly, capturing small gains that can accumulate over the course of the day, potentially leading to significant wealth within the financial markets.

The Allure of Wealth Within: Day Trading's Potential

The allure of what is day trading lies not only in its dynamic nature but also in the promise of significant gains. For many, the prospect of generating substantial wealth within a single day holds an irresistible charm. Day trading offers the potential to transform financial aspirations into reality through quick decisions and strategic actions. With access to diverse markets and advanced technologies, traders can navigate the global economic landscape, seeking profitable opportunities.

Wealth within reaches those who embrace the challenges and nuances of day trading. It demands meticulous analysis, a keen eye for market trends, and the agility to capitalize on fleeting moments of high potential returns. While risks are inherent, successful day traders often attribute their achievements to a combination of expertise, discipline, and a deep understanding of what drives financial markets.

Getting Started: Essential Tools and Preparation

Embarking on the journey of day trading requires a well-prepared mindset and a robust set of tools. Before diving into the fast-paced world of what is day trading, aspiring traders should take time to equip themselves with the essential resources. The first step is to gain a comprehensive understanding of financial markets, including stocks, forex, or commodities, depending on your preference. This knowledge forms the foundation for making informed decisions.

Additionally, creating a dedicated workspace and assembling necessary tools are crucial. A reliable computer or laptop with high-speed internet access is non-negotiable. Efficient trading software and platforms tailored to day trading will enable you to monitor markets in real time and execute trades swiftly. Ensure your device has the required specifications to handle multiple applications simultaneously without lag. Furthermore, keeping a detailed journal to track your progress and learning resources like books, online courses, or mentors can significantly contribute to your success in pursuing wealth within day trading.

Strategies for Success: Techniques and Trade Analysis

Unlocking the secrets of day trading involves mastering a blend of strategic techniques and meticulous trade analysis. For those seeking to harness the potential of what is day trading, understanding market dynamics is paramount. This includes recognizing trends, identifying key support and resistance levels, and deciphering price patterns—all vital elements in navigating the intraday markets. Successful day traders employ a variety of strategies tailored to their risk tolerance and market preferences, from scalping small profits off short-term fluctuations to swing trading based on anticipated longer-term movements.

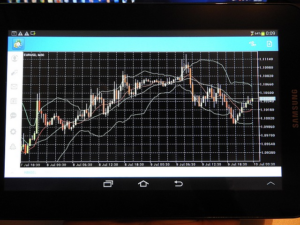

Trade analysis is the cornerstone of any robust day trading strategy. Technical analysis tools like moving averages, RSI indicators, and Bollinger Bands provide invaluable insights into potential price movements. Fundamental analysis, while less direct for intraday traders, still plays a role in understanding market sentiment and economic factors that can influence asset prices. By combining these analytical approaches, traders can make informed decisions, identify lucrative opportunities, and strive for the wealth within the dynamic day trading landscape.

Navigating Risks and Rewards: A Balanced Approach

Day trading, a high-octane strategy for generating wealth within financial markets, involves navigating a delicate balance between risks and rewards. It’s not for the faint-hearted; successful day traders must possess a keen understanding of market dynamics and be adept at making split-second decisions. The allure lies in the potential for substantial gains realized through quick buy and sell transactions, often capitalizing on temporary price fluctuations.

However, what makes day trading an art as much as it is a science is managing risk. Volatility can be your friend or foe, and unpredictable market movements can quickly turn profits into losses. A balanced approach involves setting clear risk parameters, employing stop-loss orders to limit downside exposure, and diversifying across different assets to spread risk. This strategic blend of aggression and caution is key to navigating the dynamic landscape of day trading while pursuing that elusive wealth within.

Day trading offers an exciting path towards achieving significant financial gains, or what many refer to as “wealth within”. By understanding its fundamentals, adopting a strategic mindset, and managing risks adeptly, individuals can unlock the secrets of this dynamic market. The journey begins with educating oneself about the intricacies of day trading and preparing with the right tools. With a combination of knowledge, discipline, and smart decision-making strategies, success in day trading becomes not just a possibility, but an achievable reality.