Wodonga Training: Unlocking Market Secrets for Wealth Creation Strategies

Unlocking market insights through effective stock market trading strategies is key to success in Wodonga's training programs. Participants gain confidence and skills to decipher trends, identify opportunities, and make informed decisions, d…….

Unlocking market insights through effective stock market trading strategies is key to success in Wodonga's training programs. Participants gain confidence and skills to decipher trends, identify opportunities, and make informed decisions, driving growth in their investment portfolios. Combining technical analysis (interpreting price patterns) with fundamental analysis (assessing company health) allows traders to adapt to market volatility and achieve long-term wealth goals. By demystifying complex concepts, beginners can access lucrative opportunities, while advanced tools like "Technical Analysis 101" and fundamental analysis help refine strategies for "wealth within." Proactive strategies involving economic indicators, industry reports, diversification, and regular portfolio reviews are essential for navigating today's dynamic market landscape.

“Unleash your investment potential with Wodonga’s comprehensive training on market trends. In today’s dynamic financial landscape, understanding market insights is a gateway to success. This article equips you with powerful tools, from stock market trading strategies for navigating volatility to demystifying complex trends for beginners. Discover how technical and fundamental analysis can unlock hidden opportunities, enabling you to make informed decisions and maximize your wealth in the ever-evolving market.”

- Unlocking Market Insights: A Gateway to Success in Wodonga Training

- Stock Market Trading Strategies: Tools for Navigating Volatility

- Wealth Within Reach: Demystifying Market Trends for Beginners

- Technical Analysis 101: Chart Patterns and Indicators for Profitable Decisions

- Fundamental Analysis: Uncovering the Underlying Value of Stocks

- Staying Ahead of the Curve: Predicting Market Shifts and Adapting Your Portfolio

Unlocking Market Insights: A Gateway to Success in Wodonga Training

Unlocking Market Insights offers a powerful gateway to success for those participating in Wodonga’s training programs. By mastering stock market trading strategies, individuals can navigate the complex landscape with confidence and aim for significant gains. The training equips participants with the tools to decipher intricate trends, identify lucrative opportunities, and make informed decisions that drive wealth within their investment portfolios.

In today’s dynamic financial markets, understanding market insights is not just beneficial but essential. Wodonga’s training provides a comprehensive framework to stay ahead of the curve, enabling traders to adapt quickly to changing conditions and secure their financial future. Through practical sessions and expert guidance, aspiring investors learn to unlock hidden patterns, anticipate shifts in economic indicators, and exploit emerging trends, thereby fostering a robust foundation for building substantial wealth.

Stock Market Trading Strategies: Tools for Navigating Volatility

Stock Market Trading Strategies are indispensable tools for navigating volatility and unlocking the potential for wealth within dynamic markets. By employing technical analysis, traders can decipher price patterns, identify support and resistance levels, and anticipate trends based on historical data and indicators. Fundamental analysis, meanwhile, involves assessing a company’s financial health, industry position, and market outlook to make informed decisions about stock selection.

Combining these approaches empowers investors to navigate market fluctuations with confidence. Technical indicators like moving averages, RSI, and MACD provide real-time insights into price movements, while fundamental metrics such as earnings growth, debt-to-equity ratios, and industry trends offer a deeper understanding of a company’s intrinsic value. This dual approach allows for a more comprehensive view, enabling traders to make strategic moves that align with both short-term volatility and long-term wealth accumulation goals.

Wealth Within Reach: Demystifying Market Trends for Beginners

For many newcomers to the world of finance, understanding market trends can seem like navigating a complex labyrinth. The language used in discussing stock market trading strategies often appears intimidating, shrouding wealth creation in an air of exclusivity. However, demystifying these trends is not only achievable but crucial for those seeking to unlock their potential financial freedom.

By breaking down complex concepts into digestible pieces, beginners can start to recognize patterns and signals that indicate lucrative opportunities. The key lies in developing a solid foundation of knowledge about market dynamics, historical data, and fundamental analysis. With the right tools and mindset, anyone can learn effective stock market trading strategies, turning seemingly incomprehensible trends into avenues for building wealth within reach.

Technical Analysis 101: Chart Patterns and Indicators for Profitable Decisions

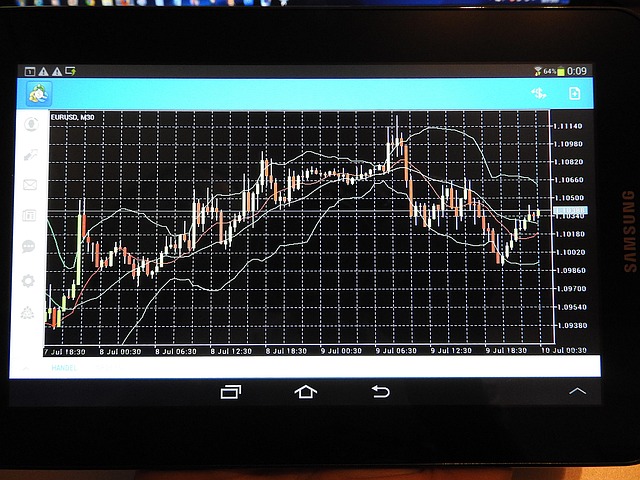

Technical Analysis 101 introduces traders to the art of interpreting chart patterns and utilizing indicators to make informed decisions in the stock market trading strategies. By understanding these visual representations, investors can uncover valuable insights into market behavior and potential price movements, ultimately aiming for wealth within their portfolios.

Chart patterns like head and shoulders, double tops, and triangles offer clues about potential trend reversals or continuations. Indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands provide quantitative signals, helping traders identify overbought or oversold conditions and potential entry or exit points for maximum profitability.

Fundamental Analysis: Uncovering the Underlying Value of Stocks

Fundamental Analysis is a powerful tool for investors looking to unlock the true value of stocks and refine their stock market trading strategies. It involves delving into a company’s financial health, examining its revenue growth, profitability, competitive advantage, management quality, and industry positioning. By understanding these fundamentals, investors can make informed decisions about whether a stock represents a good investment opportunity for generating wealth within the market.

This type of analysis goes beyond surface-level trends and market noise to reveal a company’s intrinsic worth. It encourages investors to think critically about the factors driving a business’s success or failure. Armed with this knowledge, traders can identify undervalued gems or overvalued stocks, helping them construct robust portfolios aligned with their investment goals.

Staying Ahead of the Curve: Predicting Market Shifts and Adapting Your Portfolio

In today’s dynamic market landscape, staying ahead of the curve is paramount for successful stock market trading strategies. By predicting market shifts, investors can position their portfolios to capture emerging trends and capitalize on opportunities. This proactive approach involves meticulous analysis of economic indicators, industry reports, and historical data patterns. Staying informed about global events, technological advancements, and consumer behavior changes equips traders with insights to anticipate market movements.

Adapting your portfolio to align with these predictions is key to achieving wealth within. Diversification plays a crucial role in mitigating risks associated with unpredictable shifts. Investing in a mix of sectors and asset classes allows for balance should one area underperform. Additionally, regularly reviewing and rebalancing your holdings ensures they remain aligned with your investment goals and risk tolerance, enabling you to navigate the market with confidence.

The Wodonga training program offers a comprehensive journey into the world of market trends, empowering individuals to navigate the stock market with confidence. By covering essential topics like technical and fundamental analysis, as well as providing insights into trading strategies and wealth creation, participants gain valuable tools for success. This holistic approach equips beginners and experienced investors alike to stay ahead of the curve, make informed decisions, and adapt their portfolios in a dynamic market environment.